Financial Services Guide

Version 4

Birchal Financial Services Pty Ltd

ABN 39 621 812 646 AFSL 502618

What is a Financial Services Guide?

This Financial Services Guide (FSG) helps you understand and decide if you wish to use the financial services we are able to offer you.

Birchal Financial Services Pty Ltd ACN 621 812 646 AFSL 502618 (BFS) and its employees (including any employees of a related body corporate) are collectively referred to as “us, we, our” throughout this FSG.

This FSG sets out the services we provide. It tells you:

- who we are and how we can be contacted;

- what services and products we are authorised to provide to you;

- how we (and any other relevant parties) are paid; and

- how we deal with complaints.

Please retain this FSG for your reference and any future dealings with us. Any other documents we provide you should also be read together with the FSG.

Who will be providing the financial services to you?

BFS is the authorising licensee for the financial services provided to you, and is responsible for those services and is the providing entity.

BFS authorises, and is also responsible for, the content and distribution of this FSG.

BFS’s contact details are as follows:

Licensee name: Birchal Financial Services Pty Ltd

ACN: 621 812 646

ABN: 39 621 812 646

AFSL number: 502618

Registered office: Level 2, Podium East, Rialto, 525 Collins Street, Melbourne VIC 3000

Website: www.birchal.com

Phone: +61 423 632 856

Email: BFS@birchal.com

You may be provided with services by BFS through its employees or directors (or the employees of a related body corporate). Details of our directors and employees is available on the Website at: https://www.birchal.com/company/birchal

What services and products are we authorised to provide you?

BFS is authorised to provide a crowdfunding service for fully-paid ordinary shares of an eligible CSF company published on an offer platform operated by BFS titled Birchal (Birchal Platform) accessible at www.birchal.com (Website).

BFS is also authorised to provide general financial product advice in relation to securities.

We are authorised to provide these services and products to both retail and wholesale clients.

There is an important difference between ‘general advice’ and ‘personal advice’. If we provide you with ‘general advice’ it means that we have not considered any of your individual objectives, financial situation and needs.

BFS is not authorised to provide personal advice. In providing our services, other financial matters may arise, however, we are not authorised to assist with any financial products and services except those explained above. You should consider your own specific objectives, financial situation or needs and seek specific independent accounting, financial, taxation, legal or other professional advice before making any investment decision or using our services.

Services provided on the Website

BFS provides the following crowdfunding services via the Birchal Platform on the Website:

- expression of interest (EOI) campaigns for eligible CSF companies to solicit non-binding expressions of interest from potential investors for an intended CSF Offer; and

- crowd-sourced funding offer campaigns for eligible CSF companies (we call them ‘issuers’) to offer fully-paid ordinary shares in the issuer to retail and wholesale clients using a CSF offer document (CSF Offer).

EOI campaigns and CSF Offers are facilitated by BFS via the Birchal Platform and involve the provision of a crowdfunding service. Crowdfunding services are marked on the Website with a "CSF" badge.

Gatekeeper obligations

BFS, as a CSF intermediary, has certain specific obligations that apply in recognition of its important role as a ‘gatekeeper’ for the crowdfunding services provided on the Birchal Platform, which include:

- Performing certain checks before publishing a CSF offer document on the Birchal Platform; and

- Not publishing, or not continuing to publish, a CSF offer document on the Birchal Platform in certain circumstances.

What fees are payable to us?

Investor fees

There are no fees payable by an investor or potential investor to BFS to sign up for an account on the Birchal Platform, to use the Birchal Platform, to participate in an EOI or to apply for shares under a CSF Offer.

Issuer fees

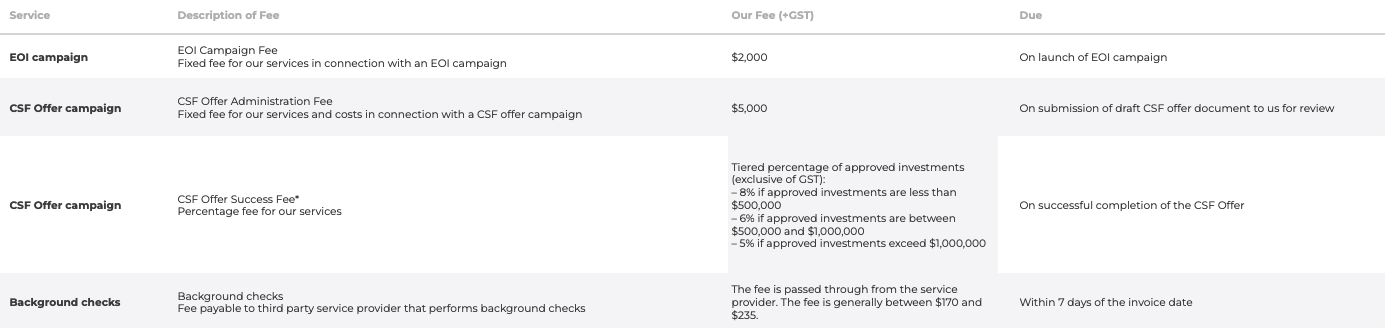

Fees payable by an issuer to BFS for our services are set out below.

Service fees

*Applicable percentage: The CSF Offer Success Fee percentage is determined by the total value of approved investments at the time the CSF Offer is successfully completed:

- 8% if total approved investments are less than $500,000

- 6% if total approved investments are between $500,000 and $1,000,000; or

- 5% if total approved investments exceed $1,000,000.

The CSF Offer Success Fees are exclusive of GST. A single rate applies to the whole amount based on the band in which the total falls.

Additional fees

From time to time, BFS or Birchal may receive additional fees as follows:

- An additional CSF Offer Administration Fee may be payable by the issuer to BFS if:some text

- an issuer requires a replacement or supplementary CSF offer document to be published on the Birchal Platform; or

- an issuer’s circumstances are complicated or unusual, for example, where we are required to perform extensive investigations to determine its eligibility (or its directors or senior managers eligibility) to make a CSF Offer;

- Interest on funds held in trust will be retained by BFS and not paid to issuers on completion of a CSF Offer or to investors if a CSF Offer is not successful;

- In certain circumstances, BFS may also receive a success fee from issuers for funds raised from outside of the Birchal Platform from a person (directly or indirectly) introduced to the issuer via the Birchal Platform or otherwise in connection with an EOI campaign or CSF Offer within 12 months of an issuer’s EOI or CSF Offer (as the case may be);

- Fees for additional services by separate agreement with the issuer.

We may deduct our fees and any other amounts due to us by an issuer from the investor application monies held by us on trust in the designated client account before we transfer any application money to an issuer on settlement of a CSF Offer.

Further information about our fees payable by an issuer to BFS are set out in the CSF Hosting Agreement.

How are we and third parties remunerated?

Directors and employees

BFS’s directors and employees (including any employees of a related body corporate) are remunerated by a combination of salary, equity and bonuses. Remuneration will depend on several factors, including role and experience, company performance, professionalism and adherence to compliance procedures and team performance.

Shareholders

BFS’s shareholders (including any shareholders of a related body corporate) may receive a benefit based on BFS’s ongoing company performance.

Referral programs

From time to time BFS or Birchal may pay referral fees to third parties that introduce issuers or investors to the Birchal Platform. Referral fees may be calculated as either a percentage of the success fee to be received by BFS, the amount raised under the relevant CSF Offer, the amount invested in a CSF Offer by an investor, or a flat fee.

Other documents that may apply to you

Website Terms of Services

Use of the Website and the Birchal Platform is subject to Birchal’s Terms of Service available on the Website at https://www.birchal.com/terms-of-service

Privacy policy

Birchal’s privacy policy applies to all websites we own and operate, all services we provide and your interactions with us. It is available on the Website at https://www.birchal.com/privacy-policy.

CSF Offer Document

If you are an eligible CSF company wishing to make a CSF Offer, you must prepare a CSF Offer Document. The CSF Offer Document must contain certain minimum information prescribed under the law. In addition, the CSF Offer Document must be worded in a ‘clear, concise and effective’ manner.

If you are considering investing in an issuer’s CSF Offer, you should consider the CSF Offer Document carefully before investing. A CSF Offer Document includes the following important information:

- Risk warning - A general risk warning about crowd-sourced funding (prescribed by law);

- Information about the company;

- Information about the offer; and

- Information about investor rights

CSF Hosting Agreement

If you are an eligible CSF company wishing to make a CSF Offer, you must enter a CSF Hosting Agreement with BFS prior to making an EOI or CSF Offer on the Birchal Platform. The CSF Hosting Agreement sets out the issuer’s & BFS’s obligations in relation to the EOI and the CSF Offer campaigns. The CSF Hosting Agreement will be provided to you by BFS.

Investor Terms

If you are an investor, by participating in a CSF Offer, you agree to and are bound by the Investor Terms & Conditions available on the Website at https://www.birchal.com/terms-and-conditions.

Subscription Agreement

All investors and issuers enter into a subscription agreement when participating in a CSF Offer on the Birchal Platform. The Subscription Agreement governs the key terms and conditions on which shares will be issued by the issuer and payment will be made by the investor. BFS is not a party to the subscription agreement.

What should you do if you have a complaint about our services?

If you have a complaint, you can contact us (using any of the details at the start of this FSG) and discuss your complaint. We will try and resolve your complaint quickly, fairly and within prescribed timeframes.

Our full complaints policy is available on the Website at https://www.birchal.com/complaints-policy

Birchal’s complaints policy explains how you can make a complaint, our measures for handling your complaint, and the steps you can take if you are not satisfied with our response to your complaint or the time that it takes for us to respond.

If the complaint cannot be resolved to your satisfaction, you have the right to refer the matter to the Australian Financial Complaints Authority (AFCA). AFCA provides fair and independent financial services complaint resolution that is free to consumers.

Website: www.afca.org.au

Email: info@afca.org.au

Telephone: 1800 931 678 (free call)

In writing to: Australian Financial Complaints Authority, GPO Box 3, Melbourne VIC 3001

Compensation Arrangements

BFS has professional indemnity insurance in place to cover itself and its representatives for the financial services we provide. We believe that the cover is adequate to meet BFS’s requirements for compensation arrangements as an Australian financial services licensee.

Further questions

If you have any further questions about the financial services which we provide, please contact us (using the details at the start of this FSG).